With the enhanced community quarantine (ECQ) in Luzon and other provinces in Visayas and Mindanao still in effect, several employees and workers could not return to work, particularly those who work in industries and businesses that were forced to temporarily suspend operations. Livelihood is gravely affected.

To support those employees and workers, the Social Security System (SSS) grants cash subsidies trough its Small Business Wage Subsidy (SBWS) program. SSS also offers Calamity Loan to the affected employees. The application period for the subsidy program has been extended until May 8, 2020.

SSS partners with PayMaya

To disburse the cash grant and loan proceeds safely and conveniently, SSS taps PayMaya. With this partnership, employees and workers who are eligible for the SBWS cash grant and calamity loan can receive funds in their PayMaya account

PayMaya is the only e-wallet system that can receive SBWS funds from the government, allowing even those without a bank account to conveniently receive the subsidy by simply signing up for a PayMaya account using their mobile devices.

All you have to do is make sure to provide your PayMaya mobile number to your employer, who will then enroll or link your PayMaya account to SSS once they have access to the SBWS application portal.

Receive your Small Business Wage Subsidy (SBWS) cash grant on your PayMaya account

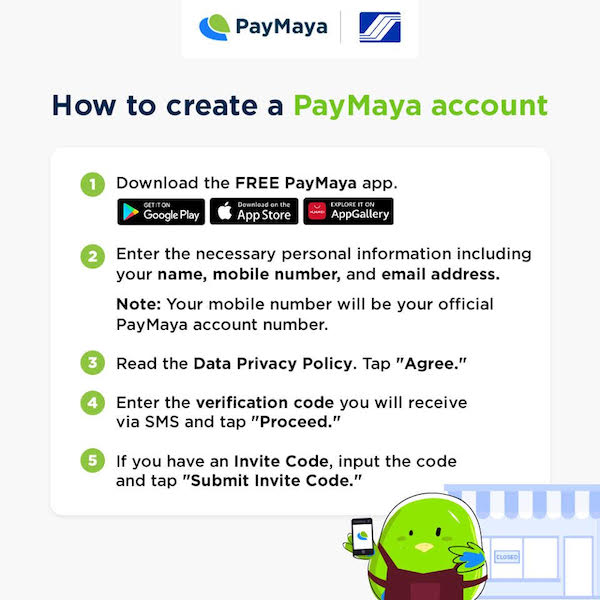

Before you can receive your cash grant using PayMaya, you need to create a PayMay account. Do the following:

- Download the PayMaya app on your iOS or Android phone.

- Register for an account using your mobile number, name, and email address.

- Enter the Verification Code that is sent to the mobile number that you use to register.

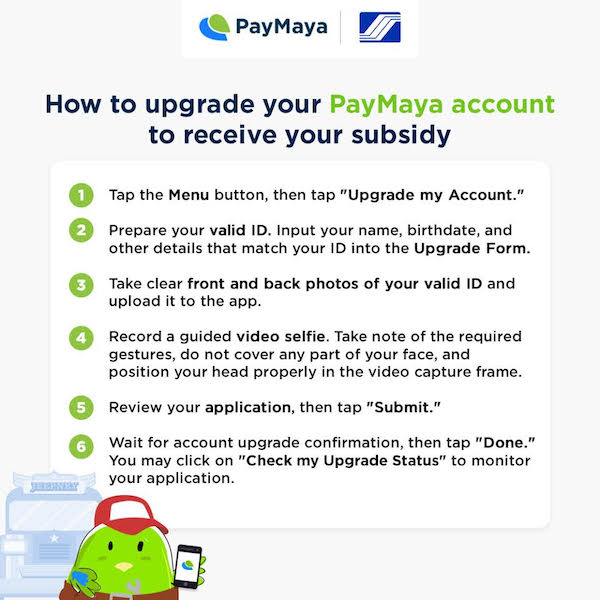

- Upgrade your account. Do not skip this step.

- To upgrade, launch the PayMaya app. On the upper left corner of the screen, click the menu icon, and then tap “Upgrade My Account”. Follow the instructions on the display.

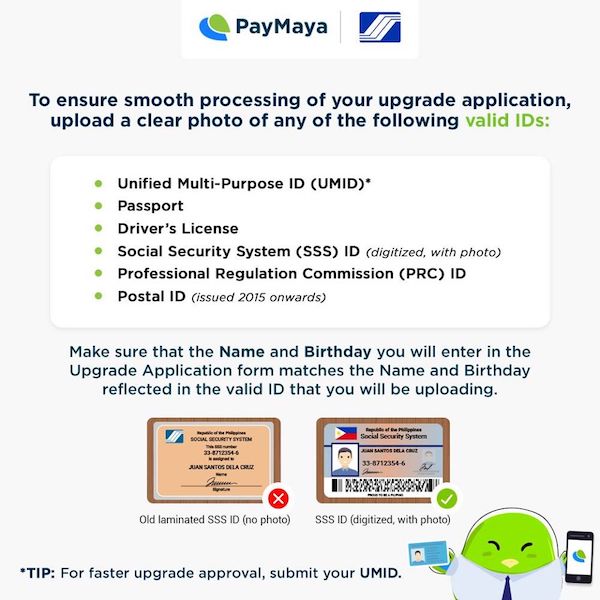

- You will be asked to provide a valid ID. For a faster and smoother upgrade process, we recommend that you upload your Unified Multi-Purpose ID (UMID).

- Make sure that the information that you provided on your PayMaya account match the information on your UMID, such as your full name and birth date.

- For more information on upgrading your account, see the video guide.

Inform your employer

Once your account is set up and upgraded, give your PayMaya account number or the mobile number that you use to register in PayMaya to your employer. Your HR will then enroll your account through the SSS online portal.

Your cash subsidy will then be credited to your PayMaya account. You may encash the funds through the 30,000 Smart Padala centers nationwide or withdraw the funds at any Bancnet ATMs using the physical PayMaya card. To get your own PayMaya card, buy one from PayMaya’s official website for 200 pesos only.

Other things that you can do with your PayMaya account

Aside from offering convenience, utilizing PayMaya for various digital transactions is also a safer way to pay as part of physical distancing and health measures. Using the PayMaya app, Filipinos can continue doing transactions such as paying their bills, settling government dues, buying airtime load for themselves or their friends, or sending money to loved ones in the provinces all at the safety of their own homes.

For more information, see PayMaya: Important Things that you can do if you have it.

About PayMaya

PayMaya is the leading digital financial services company in the country that offers end-to-end payment solutions with the widest on-ground branch network. It is the first to give millions of Filipinos an e-wallet that allows them to pay cashless transactions at any time of the day, anywhere in the world, and from any device.

Leave a reply