I stopped blogging since the pandemic but I continue to renew the domain and hosting, hoping that I will find my motivation and incite my creative impotence while on idle. My niche is travel and it wasn’t part of the plan to write again and talk about some random deceitful apps.

Applying an online loan from some random providers is not part of the plan, either. But since here I am, already been caught in an unfortunate circumstance, I am back in wp-admin. The experience, though, is quite fascinating despite the random hiccups, spiced with a bit of stress and displeasure.

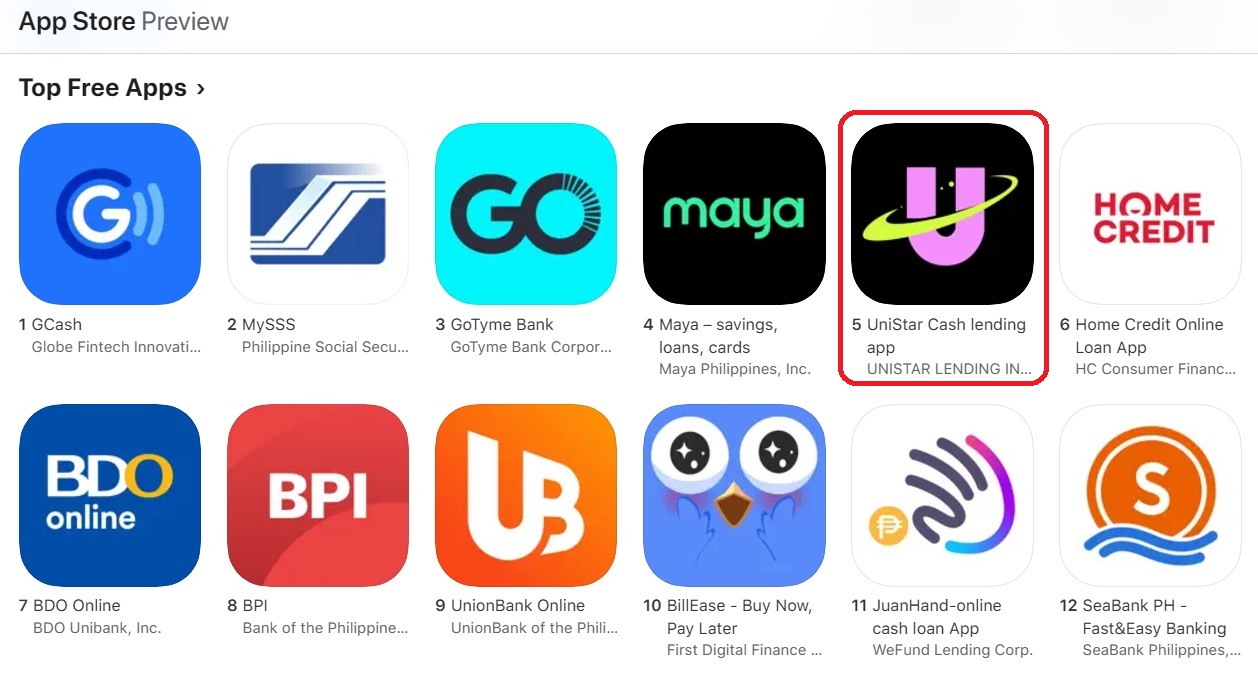

To cut the chase, I stumbled onto the Unistar Cash Lending App from the Apple App Store. I had read the reviews, everything from the “spammy” 5-stars, and the most critical, yet very helpful 1 stars. However, I was so inquisitive and was oddly interested to try that very day—so despite the warnings, I installed the app—a blatant disregard of all the red flags. Forgive me, I was dumb and broken hearted that day!

From here on, I will just state all the facts that transpired. No assumptions! No opinions! Just pure facts.

Evening of November 27, 2024, Unistar app installed

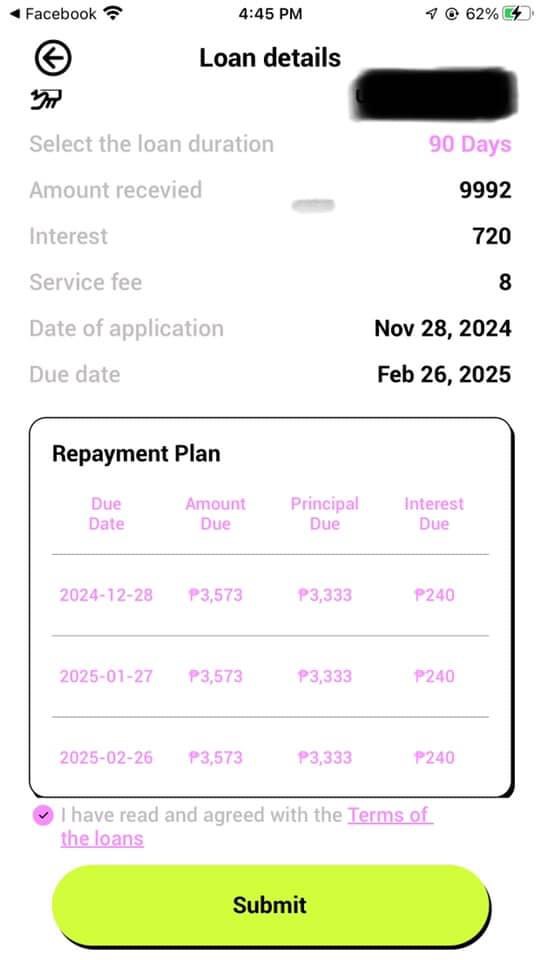

It was already passed 10:00 PM when I installed the app, signed up, provided my info, and then viola, I was offered my first loan online! 10,000 pesos with a monthly amortization of ₱3,573. If you complete the payment, the total interest will be ₱719 only plus the 8-peso service fee, which will be deducted from the amount to be disbursed. Sounds like a good deal, right?

I knew that I do not need the money at the time, but since it was a great offer, and I also planned to splurge on gas for my weekend road trip plan, I submitted my application. To get approved, I had to grant them permission to view my contacts. I okayed without prejudice, without hesitation, without an intention to run!

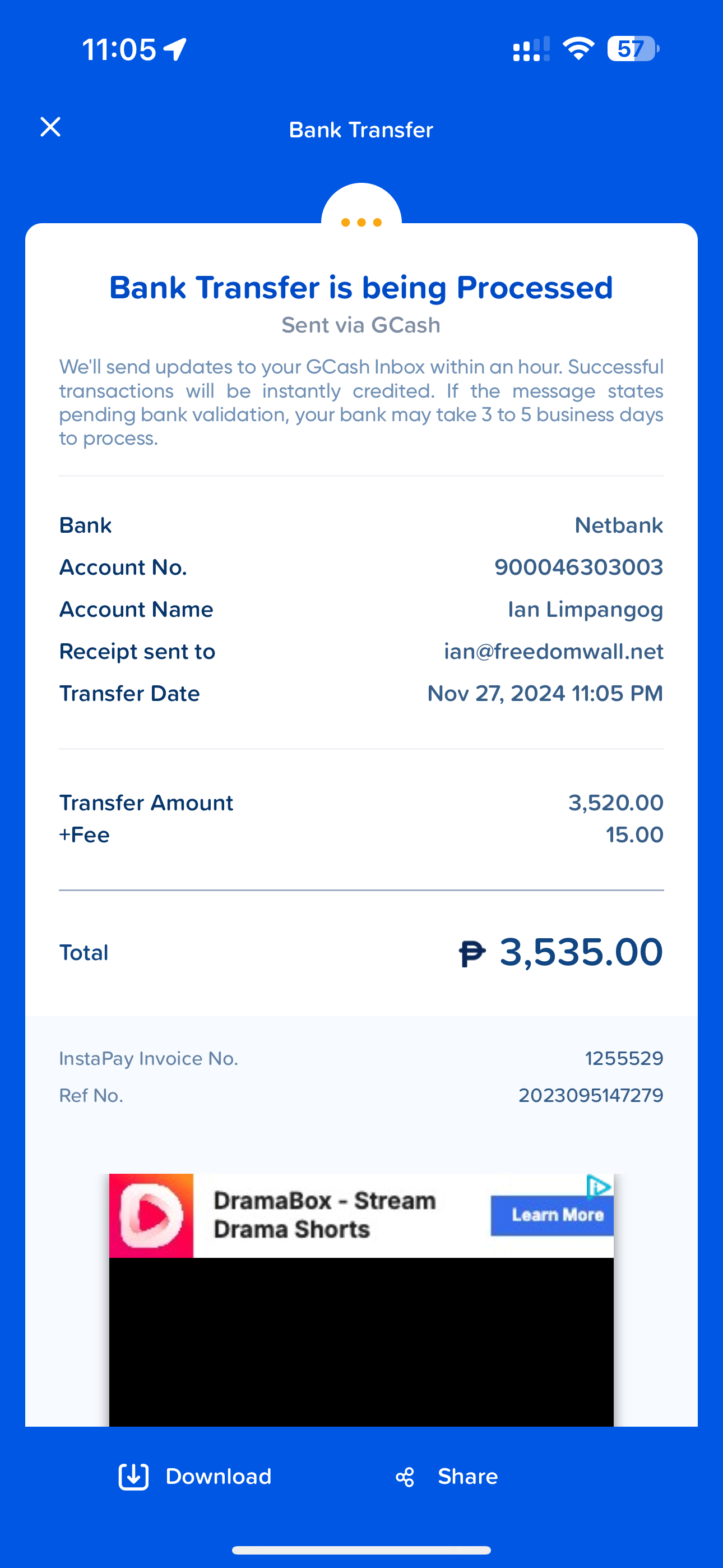

Approval, Transfer, and Return of the Principal Amount to Unistar

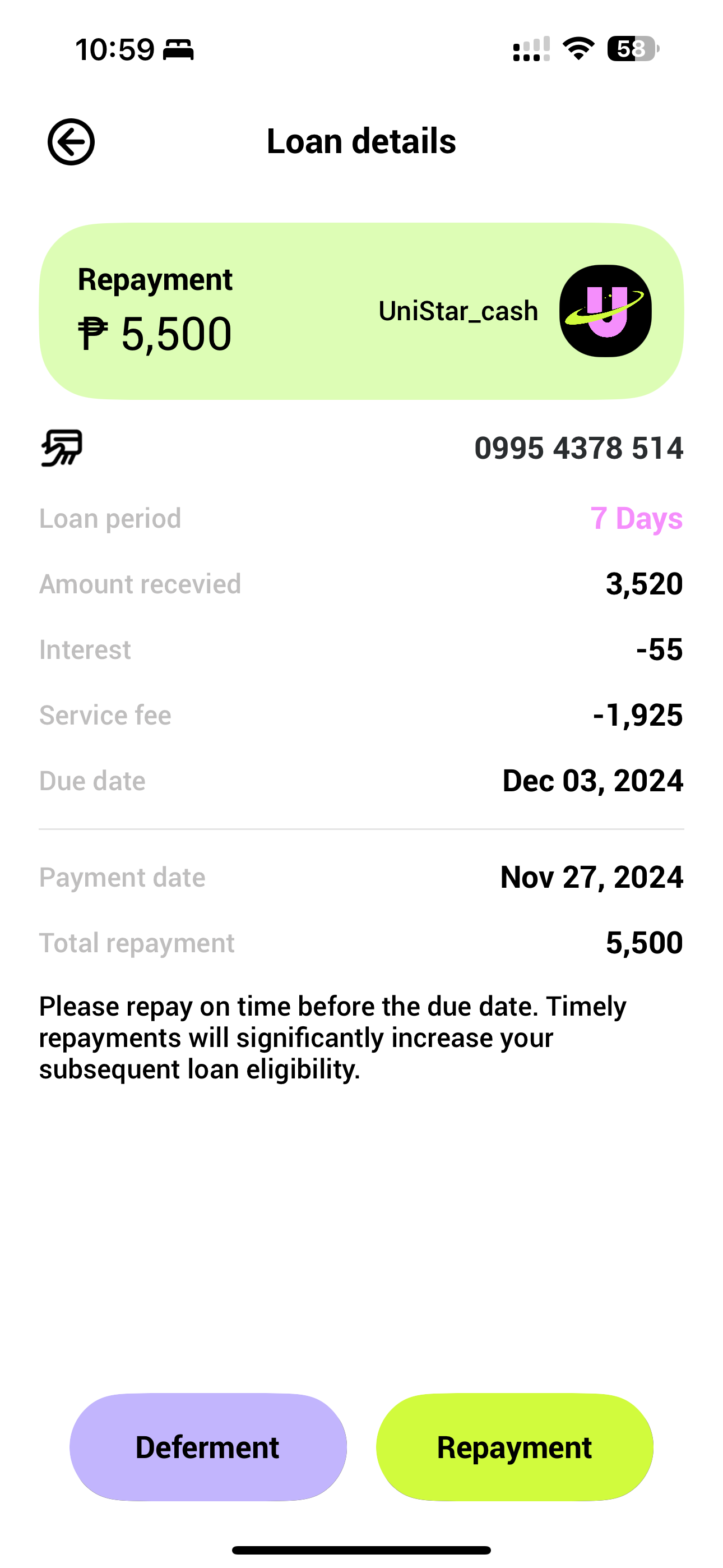

Around 10:35 PM, I received a money in my GCash Account worth ₱3,520. I was not expecting any money from anyone, so I immediately thought of the Unistar Cash app. I checked the app and confirmed that my loan was approved. It was both surprising and depressing that they altered the loan amount (from ₱10,000 to just ₱3,520), the terms of payments (from once a month for three months to once a week for one week), the maturity (from 3 months to one week), and the service fee (from ₱8 to a screaming ₱1,925).

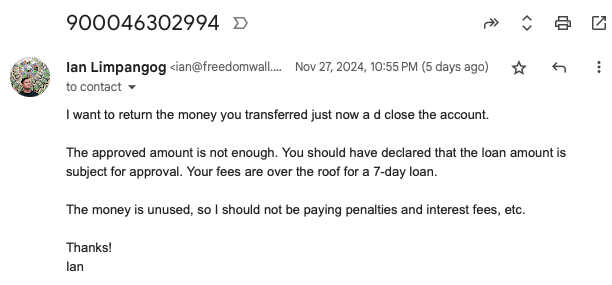

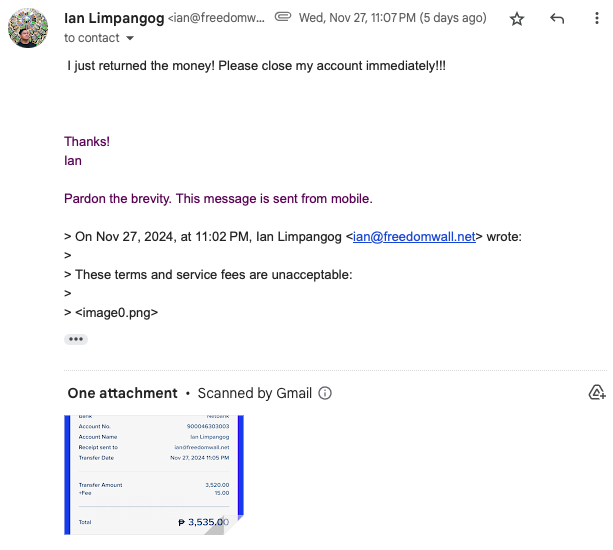

They transferred the loaned money to my account without consulting or informing me first about the changes. And so, I emailed them that very night. They did not respond. The eerie silence screams deceit (this statement is an opinion)!

I made multiple follow up emails after that, but still, they did not respond. I also contacted two of their mobile numbers and I still did not get any comment from them. Since they were completely silent, I returned the money via GCash through the payment details they provided.

As per Truth in Lending Act or RA 3765, loan terms shall be disclosed to all types of borrowers:

- The total amount to be financed;

- The finance charges expressed in terms of pesos and centavos;

- The net proceeds of the loan; and

- The percentage that the finance charge bears to the total amount to be financed expressed as a simple annual rate or an EIR as described in Item “h” of Definition of terms in this Section. EIR may also be quoted as a monthly rate in parallel with the quotation of the contractual rate.

In addition, “lenders are required to furnish each borrower a copy of the disclosure statement, prior to the consummation of the transaction.“

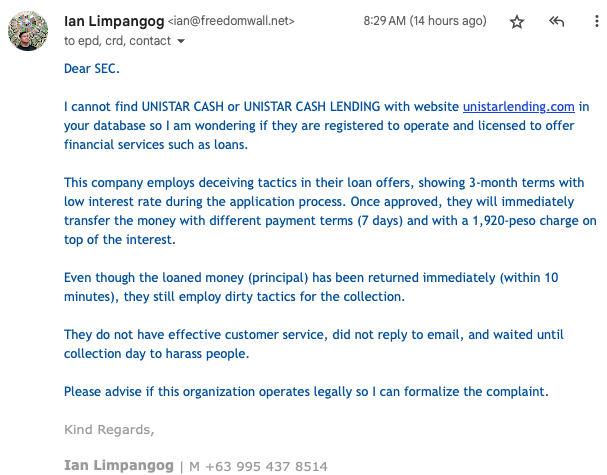

Therefore, I do not believe that they can alter the terms of the loan without the borrowers’ prior knowledge and approval. Changing the loan terms without both parties’ approval is a breach of contract.

Unistar is not faithful in the offer. They made an offer with an intention to deceive the borrower! This is not an opinion. This is a fact.

Collection Harassment

Despite contacting them multiple times to rectify the issues in my account, they ignored me. I also contacted the cellphone numbers they posted in their website but to no avail.

Here came the 7th day maturity, they kicked off the collection process. I told them that I already returned the principal and that I am not subject for any excessive service fees and interest since I immediately returned the money. They violated RA 3765 too, which is a breach of our loan contract, and thus, I have a right to terminate the contract by returning the principal amount.

What follows were series of horrors, name calling, cheap tactics of gaslighting, etc. Since they got a permission to access my contacts, they downloaded the list and sent everyone a text message about the loan. But instead of getting raged, I found it funny. The collection agents were not too bright to engage in an intelligent discussion, so I just blocked one of them.

They will continue to harass me in the future but I am here to fight. I felt injustice and shutting them down legally is the only form of relief.

I am sorry to those who received the message. Please ignore them, they cannot demand something from you since you did not sign any document. They do not have access to your social media accounts contrary to what was stated in their messages. Block their numbers if you find them annoying! You may also send screenshots to me so I can add them in the evidences.

Actions I did to stop Unistar Lending from deceiving people

If you are a victim, you can do this too:

- I left an honest review in the Apple App Store to warn other users. A reminder to some of you, DO NOT leave 5 stars along with your displeased comment! Some of you are inconsistent!

- I reported the app to Apple for Fraud and Privacy Policy violations. Hope they will notice and take action.

- I alerted National Bureau of Investigation (crd@nbi.gov.ph) and the Securities and Exchange Commission (epd@sec.gov.ph) through email. I will be persistent in the following days if they will not take action.

- I reported their website to Google for phishing.

I do not support deceit so I will fight. You probably say that the amount is not worth the hassle but I want to win this. I want to put an end to their inappropriate schemes!

By the way, you may find some ads in this blog about online loan apps. Exercise restraint and do not click. There may be legit online loan apps out there, but it’s hard to tell who’s doing fair. I suggest you stay away from all of them!

As of today, December 2, 2024, Unistar cash lending app is number 5 in the Apps Store’s finance apps. The scale and coverage is scary! Mind you, they also have ads basically everywhere, such as in Tiktok, Facebook, IG, and even in Apple App Store. They are aggressive in marketing their debt trap, so they they are aggressive in the collection too.

How about you? What is your story with Unistar? Is Unistar a scam or scum?

I had the same and have had terrible experience with Unistar Cash (Go Fund) and I want to warn others about their unfair lending practices, harassment, and privacy violations. Would like to know how did you manage this? Have you filed a case or reported them to PNP or NBI anti cybercrime?

Thank god the app is banned but there website is still operating unfortunately and therefore it should be banned and reported to the police because more people will fall victim to this farce website